平安养老保险股份有限公司来华人员综合医疗保险保障计划简介

投保条件

来华留学生、港澳台学生及华侨学生(华侨身份须由相关单位出具证明),凡身体健康、能正常参

加学习的、年龄在 6-69 周岁可参加本保险。

保险责任

在保险期间(从本次保险生效日期到截止日期的期限)内,本公司承担下列保险责任:

1、身故保险责任:

被保险人因意外事故或疾病身故,本公司按约定保险金额给付保险金,保险责任终止。

2、意外残疾保险责任:

被保险人因遭受意外事故,并自事故发生之日起 180 日内因该事故造成《人身保险伤残评定标准及 代码》(JR/T0083—2013)(原中国保险监督管理委员会发布,保监发〔2014〕6 号)所列伤残项目的, 本公司依照该标准规定的评定原则对伤残项目进行评定,除另有约定外,本公司按评定结果所对应该标 准规定的给付比例乘以相对应责任下的保险金额给付意外伤残保险金。如治疗仍未结束的,按事故发生 之日起第 180 日的身体情况进行伤残鉴定,并据此给付意外伤残保险金。

被保险人该次意外事故导致的伤残合并前次伤残按照《人身保险伤残评定标准》可评定为较严重项

目的,本公司按较严重项目标准给付,但前次已给付的意外伤残保险金(投保前已有或因责任免除事项 导致《人身保险伤残评定标准及代码》(JR/T0083—2013)(原中国保险监督管理委员会发布,保监发 〔2014〕6 号)所列伤残的,视为已给付意外伤残保险金)应予以扣除。

每一被保险人的意外伤残保险金累计给付金额以该被保险人的保险金额为限,累计给付金额达到

其保险金额时,对该被保险人的保险责任终止。

注:《人身保险伤残评定标准及代码》(JR/T0083—2013)(原中国保险监督管理委员会发布,保

监发〔2014〕6 号)可登陆中国保险行业协会网站查看。

每一被保险人的意外残疾、意外身故、疾病身故保险金的累计给付金额以其对应的保险金额为限。

3、意外伤害医疗保险责任:

被保险人因遭受意外事故,并自事故发生之日起 180 日内进行治疗,保险人就其实际支出的合理且 必要的医疗费用按 100%给付意外伤害医疗保险金,累计给付金额以 20,000 元为限。被保险人不论一次或 多次发生意外伤害保险事故,保险人均按上述规定分别给付“意外伤害医疗保险金”,但累计给付金额 以不超过该被保险人的保险金额为限,累计给付金额达到其保险金额时,对该被保险人的该项保险责任 终止。

即:如因磕伤、烧烫伤、崴脚、切菜不小心切着手、猫狗抓咬伤等等造成意外伤害事故的;

报销公式:合理费用合计*100%=可报销金额(合理费用合计不含当地社会基本医疗保险规定的自费

及部分自费费用)。

4、门急诊医疗保险责任:

被保险人因疾病在门诊、急诊进行治疗所发生的合理且必要的医疗费用,在一个保险期间内,就诊日费用限额为 600 元(即:若当日医疗费用超日限额的只能按 600 元计算,当日医疗费用未超 600 元限额 的按实际发生金额计算),在日限额的基础上累计超过 650 元免赔额以上的部分按照 85%比例赔付,累计给付保险金额以 20000 元为限。当累计给付金额达到其保险金额时,对被保险人的该项保险责任终止。

门急诊医疗费用包括:普通门诊、急诊、门诊手术、急诊留观、急诊抢救所产生的相关费用;由公

立医院或卫生防疫部门提供证明的传染病因隔离期间所产生的相关费用;因与住院同一病因而产生院前、院后的门诊费用等均归属于门急诊医疗责任范围内。

即:如因发烧、突然腹痛、晕倒、身体某处炎症等等在门诊或急诊进行治疗的;

报销公式:(每天在日限额 600 元以内的费用相加-650 元)*85%=可报销费用(合理费用合计不含当 地社会基本医疗保险规定的自费及部分自费费用)。

释:

日限额:为每日就诊的最高费用限额。

免赔额:本险种设置 650 元为免赔额(一个保险期间内累计扣一次 650 元),免赔额以下部分不予赔付。

5、住院医疗保险责任:

被保险人因遭受意外事故或疾病,经医院诊断必须住院治疗的,本公司就其实际支出的合理且必要的 护工费(限额 200 元/天,最多累计 60 天)、建病历费、取暖费、空调费、床位费、检查检验费、特殊 检查治疗费、手术费、药费、治疗费、化验费、放射费等合理医疗费用,按 100%的比例向被保险人给付 “住院医疗保险金”。

在一个保期内,被保险人不论一次或多次住院治疗,本公司均根据理赔规则向其给付保险金,每次

给付的住院医疗保险金累计相加达到 400,000 元时,该项保险责任终止。

即:因受伤或生病后,经医院诊断必须住院治疗,可申请网络医院住院垫付或自付后申请报销;

报销公式:合理住院费用*100%=可报销费用(合理费用合计不含当地社会基本医疗保险规定的自费

及部分自费费用)。

注:

1)以上所有医疗保险责任所涉及的医疗机构仅限于在中华人民共和国大陆境内的公立医院。但是,

若被保险人是在公立医院的分院、外宾病区、VIP 病区、包房、A 等病房、单间、特诊特需病区、特诊特需病房和高干病房等同类病区或病房接受的治疗,则其所有的医疗费用本公司均不予报销。

2)以上所有医疗保险责任所涉及的医疗费用只限于当地社会基本医疗保险可报销项目内的费用,自费和部分自费项目本公司均不予报销。

3)首次投保或非连续投保的被保险人,自投保之日起 30 日内为等待期(观察期),如等待期内发生住院或疾病门诊的医疗费用,本公司不承担理赔责任。连续投保或被保险人遭受意外事故进行治疗的无等待期。

4)以上所有医疗费用,若其它第三方支付了部分或全部费用,我司仅就剩余的、且在当地社会基本医疗保险可报销项目范围内的合理费用予以赔付;但保险责任中所涉及的床位费、护工费、门急诊日限额等限额部分同样受限,如第三方有赔付比例的受限部分按照受限金额为基础扣除已赔付金额,我司只赔付剩余金额,如无赔付比例,受限部分按照当地社会医疗保险的标准, 以受限金额为基础扣除此项目的标准金额,赔付剩余金额,并以保险金额为限。

5)被保险人在本次投保前发生重大疾病或慢性病的,保险人不承担给付保险金的责任。

责任免除

一、身故及残疾保险责任免除

因下列情形之一导致被保险人身故、伤残的,本公司不承担给付保险金的责任:

(一)投保人、受益人故意杀害或故意伤害被保险人;

(二)被保险人故意自伤、自杀、故意犯罪或者抗拒依法采取的刑事强制措施;

(三)被保险人殴斗、醉酒或受酒精影响,主动服用、吸食或注射毒品;

(四)被保险人酒后驾驶、无合法有效驾驶证驾驶,或驾驶无有效行驶证的机动车;

(五)战争、军事冲突、暴乱或武装叛乱;

(六)核爆炸、核辐射或核污染;

(七)被保险人妊娠、流产、堕胎、分娩(含剖腹产)、避孕、节育绝育手术、治疗不孕不育症、

人工受孕及由以上情形导致的并发症;

(八)被保险人因整容手术或其他内、外科手术导致医疗事故;

(九)被保险人未遵医嘱,私自使用药物,但按使用说明的规定使用非处方药不在此限;

(十)被保险人患爱滋病(AIDS)或感染爱滋病毒(HIV呈阳性)期间;

(十一)被保险人从事潜水、跳伞、攀岩、蹦极、驾驶滑翔机或滑翔伞、探险、摔跤、武术比赛、

特技表演、赛马、赛车等高风险运动;

(十二)被保险人在中国大陆地区以外身故或造成残疾的;

(十三)提供虚假投保信息的,外籍专家及外教以学生身份投保的;

(十四)留学生在勤工助学期间发生的事故。

发生上述情形之一,被保险人身故的,本公司对该被保险人保险责任终止。

二、医疗保险责任(意外伤害医疗、门急诊医疗、住院医疗)免除

因下列情形之一造成被保险人医疗费用支出的,本公司不承担给付保险金的责任:

(一)投保人、受益人故意杀害或故意伤害被保险人;

(二)被保险人故意自伤、故意犯罪或者抗拒依法采取的刑事强制措施;

(三)被保险人殴斗、醉酒或受酒精影响,服用、吸食或注射毒品;

(四)被保险人酒后驾驶、无合法有效驾驶证驾驶,或驾驶无有效行驶证的机动车;

(五)战争、军事冲突、暴乱或武装叛乱;

(六)核爆炸、核辐射或核污染;

(七)被保险人患先天性疾病、遗传性疾病、既往症(投保前已患疾病或已存在的症状,保险期间非

连续的);

(八)被保险人患艾滋病或感染艾滋病病毒、性病;

(九)被保险人怀孕、流产、分娩、不孕不育症治疗、人工受精、产前产后检查;节育、堕胎,及

以上原因引起的并发症;

(十)被保险人因整容手术或其它内、外科手术导致医疗事故;

(十一)被保险人因牙护理,如洗牙、牙移植、义齿、镶牙、烤瓷牙等发生的医疗费用,以及口腔

修复、口腔正畸、口腔保健及美容所发生的费用;(被保险人因龋齿、牙髓病、牙隐裂所引起的补牙、

34

治牙神经、拔牙、阻生齿治疗以及牙周组织疾病,如牙周炎、牙龈炎、根周炎(洁牙治疗除外),所发

生的合理医疗费用,属于保险人保险责任范围);

(十二)被保险人因矫形、矫正、整容或康复性治疗等所支出的费用;

(十三)被保险人如体检、疾病普查等项目;各种预防、保健性、疗养、静养或特别护理的诊疗项

目:如各种疫苗预防接种、足部反射推拿疗法、健身按摩等项目;

(十四)被保险人未遵医嘱,私自服用、涂用、注射药物;

(十五)在中国大陆地区以外发生及中国大陆境内私立医院发生的医疗费用及药店、医疗器材公司

所支出的费用;

(十六)被保险人在中国大陆地区以外发生的意外事故及后续治疗;

(十七)被保险人支出的电话费、交通费等;

(十八)专业人 员 参 与 的 高 风 险 运 动 及 高 危 竞 技 类 活 动 ,如 被保险人从事潜水、跳伞、滑

翔伞、滚轴轮滑、滑雪滑冰、蹦极、攀岩、摔跤、柔道、跆拳道、武术、空手道、击剑等高风险运动;

(十九)提供虚假投保信息的,外籍专家及外教以学生身份投保的;

(二十)被保险人在医院进行试验性治疗,且以医学实验为目的所产生的相关费用;

(二十一)严格按照就诊医院的入院标准就医,未达到入院指标,但被保险人按自己意愿住院的费用

不予报销;

(二十二)未提前拨打400电话询诊或未审核通过的相关就诊费用;

(二十三)留学生在勤工助学期间产生的相关费用。

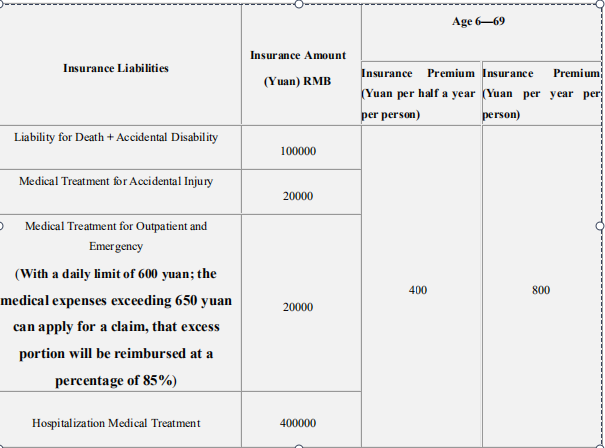

保险费

|

保障责任 |

保险金额 (元)RMB |

6—69岁 |

|

|

保险费 (元/人·半年) |

保险费 (元/人·年) |

||

|

身故+意外残疾 |

100000 |

400 |

800 |

|

意外伤害医疗 |

20000 |

||

|

门、急诊疾病医疗 (日费用限额600元,免赔额650元以上的部分按照85%赔付) |

20000 |

||

|

住院医疗 |

400000 |

||

注:未尽事宜以《平安附加残疾保障团体意外伤害保险(2013 版)(D 款)》、《平安一年期团体定期 寿险》、《平安附加意外伤害团体医疗保险》、《平安住院门诊急诊综合团体医疗保险》、《平安住院 团体医疗保险》等条款执行。

以上内容若有争议,以中文的解释为准。

就医前务必拨打电话 4008105119 进行询诊

尊敬的客户:

您如果想了解平安养老保险股份有限公司来华人员综合保险理赔服务事项,请您仔细阅读如下内容。(一)理赔程序:

保险事故发生后,理赔的规范程序:

咨询、报案电话:4008105119

因疾病或意外事故需就诊,需直接致电 4008105119,由救援医生进行健康询诊、就医指导及理赔注意事 项说明。如经过询诊且门诊治疗后医生确诊需进一步住院治疗的可向救援公司申请住院垫付,救援公司 与医院沟通确认后决定是否启动住院垫付程序。凡未经救援公司医生询诊备案且未经门诊诊治而直接入 院治疗的(包括病情未达到住院程度却要求门诊医生同意住院治疗的),救援公司不负责住院费用垫付。

对于未按照上述程序申请的,个人自行垫支医疗费用的将无法获得赔付。

(二)理赔应备文件:

1).身故或意外伤残

A 被保险人护照复印件及签证页复印件

B 被保险人伤残时需提供伤残鉴定证明(由指定鉴定机构出具鉴定报告)

C 被保险人死亡证明

D 被保险人与所有受益人关系证明及受益人身份证明复印件。

E 如意外事故须提供意外事故证明及相关部门的定性材料(如:交通事故须出具交通部门的交通事故责任 认定书,高坠、溺水等须公安机关或相关部门出具事故属意外或自杀的定性材料,饮酒导致事故须出具酒精含量定量报告)

2).意外伤害医疗

A 被保险人护照复印件及签证页复印件

B 意外事故经过及证明(如是交通事故须出具交通部门的交通事故责任认定书等)

C 收费收据原件

D 相对应每次就诊病历(病例日期须与发票日期一一对应),费用明细,检查、化验报告单复印件

3).门急诊医疗

A 被保险人护照复印件及签证页复印件

B 收费收据原件

C 相对应每次就诊病历(病例日期须与发票日期一一对应),费用明细,检查、化验报告单复印件

如果已满 650 元免赔额,须提交 650 元以下的发票原件、病历、费用明细、检查化验报告单的复印件。

4).住院医疗

A 被保险人护照复印件及签证页复印件

B 如意外事故须提供意外事故证明(如是交通事故出具交通部门的交通事故责任认定书等)

C 住院收据原件、费用明细原件

D 出院小结或住院病历复印件

以上 2)—4)项特别说明:

(1)每次申请理赔,申请材料中必须附上被保险人中国大陆境内的银行账号及该账号的准确账

户信息,包括账户名、账号和开户行信息,可通过存折复印件或银行客户信息表载明以上信息。(详

情请拨打 4008105119 进行咨询)

(2)若一次保险事故分别在两家(包含两家)以上医院就诊,须出具每次就诊的诊断证明书、病

历复印件等相关文件。

56

(3)就诊医院必须是中华人民共和国大陆境内的公立医院,申请理赔费用应属于当地社会基本医疗

保险规定可报销的范围之内的费用。

5).护工费申请

住院期间医院或护工服务公司出具的护工费发票原件。

理赔材料寄送地址:北京市西城区金融街 23 号平安大厦 9 层(邮编 100033)

收件人:来华项目组

电 话:4008105119

本方案为保险产品组合

最新保险简介更新内容,请及时登录留学保险网 www.lxbx.net 网站查阅

以上内容的最终解释权归属平安养老保险股份有限公司所有。

若有争议,以中文解释为准。

Comprehensive Medical Insurance & Protection Scheme for

Foreigners Staying in China of Ping An Annuity Insurance Co., Ltd.

To participate in conditions:

International students in China, students from Hongkong, Macao and Taiwan, as well as overseas Chinese students (identities are needed to be proved by relative authority) in healthy condition, able to participate in study normally and from 6 to 69, are eligible to this policy.

Insurance Liabilities:

Ping An shall undertake the following insurance liabilities during the valid period of insurance (Insurance period (from the valid date of the policy to the expiry date of the insurance period))

1. Death insurance:

Ping An shall pay the stipulated amount of insurance compensation if the Insured dies of an

accident or disease. Insurance liabilities thus terminate.

2. Accidental disability insurance:

If the Insured suffers from an accident which results in any disability listed in the Standards and Codes for Personal Insurance Disability Assessment (JR/T0083-2013) (issued by former China Insurance Regulatory Commission, BJF [2014] No. 6) within 180 days since the occurrence of the accident, Ping An shall assess the injury and disability according to the assessment principles stipulated by this Criteria, unless otherwise stipulated, Ping An shall pay the accidental disability insurance money, whose amount shall be calculated based on the multiplication of the proportion stipulated in this Criteria, which is corresponding to the assessment result, by the sum insured, which is corresponding to insurer’s responsibilities. If medical treatment is still not over on the 180th day, disability evaluation shall be made on the basis of the Insured’s physical condition on that day and the Insurance of Accidental Disability shall be paid in accordance with the

evaluation results.

If with the disability resulted from this accident and the previous disability combined as a more serious disability according to the Injury and Disability Assessment Criteria for Personal Insurances, the insurance shall be paid in accordance with the standard for the more serious disability, but the insurance of accidental disability which has been paid previously (disabilities listed in the Standards and Codes for Personal Insurance Disability Assessment (JR/T0083-2013) (issued by former China Insurance Regulatory Commission, BJF [2014] No. 6) have taken place before purchase of insurance or caused by events under Liability Exemption, shall be deemed as having been compensated already) shall be deducted therefrom.

The accumulative amount of accidental injury and disability insurance payment shall not exceed the insured sum of the insured. If the accumulative amount of payment exceeds the insured sum of the insured, then the insurance liabilities to the insured thus terminate.

Note: Standards and Codes for Personal Insurance Disability Assessment (JR/T0083-2013) (issued by former China Insurance Regulatory Commission, BJF [2014] No. 6 is accessible from the website of INSURANCE ASSOCIATION OF CHINA.

The accumulative amount of insurance payment of each insured for accidental disability,

accidental death or death of disease shall not exceed the insured sum of the insured’s total insurance for the accidental disability, accidental death or death of disease.

3. Medical Insurance for Accidental Injury:

If the Insured, who suffers from the accidental incident, receives medical treatment within 180 days since the occurrence of the accident, the Insurer shall be liable for the full amount of the reasonable and necessary expenses actually paid by the Insured for the medical treatment, but the accumulative amount of payment shall not exceed RMB 20,000. Whether an accidental injury happens to the Insured for once or several times, the Insurer shall pay the “medical insurance for accidental injury” respectively in accordance with the aforesaid provisions, but the accumulative amount of payment shall not exceed the insured sum of the Insured. When the accumulative amount of payment reaches the insured sum of the Insured, the said insurance liability for the said Insured shall be terminated.

For example, the accidental injuries such as bruises of bumps, burns, sprained ankle, accidental cut- wound when cutting vegetables, scratches and bites by cats and dogs.

Reimbursement equation: total amount of reasonable expenditure * 100%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the social basic medical insurance)

4. Outpatient and Emergency Medical Insurance:

The reasonable and necessary expenses incurred by the Insured for receiving outpatient or

emergency medical treatment because of illness, within each insurance period, the daily limit for outpatient is RMB600, (that said, for the medical expense of the day exceeding RMB 600 shall be calculated as RMB600, for the medical expense of the day not exceeding RMB600 shall be calculated by the actual amount). For the medical expenses exceeding the starting line of RMB650, The remaining amount of the medical expenses exceeding the deductible RMB650 yuan on the basis of the daily limit will be reimbursed at a percentage of 85%, and the accumulative payment shall not exceed the limit of RMB20000. The insurance liability shall be terminated once the accumulative amount of payment reaches the sum insured.

Medical expenses of outpatient and emergency treatment: The related expenses incurred from 2general outpatient treatment, emergency treatment, outpatient surgery, hospitalization for observation, emergency rescue, isolation due to infectious diseases that is certified by the public hospital or department of public health and epidemic prevention, and expense or cost of outpatient and emergency treatment before and after hospitalization that arise from the same cause of disease are also deemed as outpatient and emergency treatment.

For example, being treated in the outpatient or emergency for fever, sudden abdominal pain, faint, and inflammation etc.

Reimbursement equation: (the expense of each day within the daily limit RMB600 yuan add up-650 yuan) * 85%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the social basic medical insurance)

Notes:

Daily limit: The top claim limit of available medical cost

Deductible: RMB 650 yuan (A total of RMB650 yuan is deducted accumulatively for one time

during an insurance period). Below the starting line, there is no compensation.

5. Hospitalization and Medical Insurance:

If diagnosis confirms that the Insured must be hospitalized for treatment because of suffering from the accident or the illness, Ping An shall pay 100% of the “hospitalization and medical insurance” to the insured with regard to the actual and reasonable expenses for medical treatment, including reasonable and necessary fees for nursing (limited to RMB200 Yuan per day and accumulate up to 60 days), medical record, heating, air-conditioning, bed, examination, special examination and treatment, operation, medicine, treatment, laboratory test, radiation, etc.

During one valid insurance period, whether the Insured is hospitalized for once or several times, the Insurer shall pay the insurance payment as per compensation rule, but the insurance liability shall be terminated once the accumulative amount of payment reaches the limitation of RMB 400,000.

In another word: if diagnosis confirms that the insured must be hospitalized for treatment because of suffering from the injury or illness, the insured may apply online for advanced payment by the hospital or at his own expense of medical expense for hospitalization and reimburse later.

Reimbursement equation: reasonable hospitalization expenditure * 100%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the social basic medical insurance)

Note:

1) Medical organizations which are involved in all the foregoing medical insurance liabilities are limited to the public hospitals established within the border of Mainland China; However, for the insured who are treated in sub-branch of public hospitals, ward area for foreigners, ward area for VIPs, private room, Class A ward, separate ward room, ward area for special treatment and needs, ward for special treatment and needs, ward for high-ranking officials, or similar ward area, shall be excluded from the insurance, then all medical expenses incurred by such shall not be covered by the insurer.

2) Medical treatment expenses generated by all the foregoing medical insurance liabilities are limited to the items and expenses that can be reimbursed in accordance with the local regulations of social basic medical insurance, the self-paid or partly self-paid items and expenses cannot be reimbursed by the insurer.

3) For the insured who apply for the insurance for the first time or the insured who is not continuously insured, the first 30 days since the purchase of the insurance is the waiting period (observation period). Where the insured is hospitalized or treated in outpatient during the waiting period and related medical cost occurs, the insurer bears no liability of compensation. The treatment for the insured of continuously insured or the Insured suffered from an accident is not subject to any waiting period.

4) If any third party has partially or fully paid any above-mentioned medical treatment fees, Ping An shall be liable for the remaining amount of reasonable fees that are within the

reimbursable payment scope of the local social basic medical insurance. But the limited portion of the fees for the bed, nursing, outpatient and emergency treatment within the daily limitation is also limited; if the third party has a specified proportion for payment of the limited sum, Ping An shall be liable only for the remaining amount after deducting the already paid amount from the limited sum. If the third party has no specified proportion for payment, then Ping An shall be liable for the remaining amount, but not exceeding the insured sum, after deducting the standard amount of this item from the limited sum which takes the regulations of the local social medical insurance as the standard.

5) If the Insured suffers from a major disease or a chronic disease before the purchase of this insurance, the Insurer shall not bear the liability of payment.

Liability Exemption

I. Liability Exemption for Death and Disability Insurance

Ping An shall be exempted from the insurance liabilities for death and disability caused by

any of the following circumstances on the part of the Insured:

1. Deliberate killing or injury conducted by the policy-holder or beneficiary to the

Insured;

2. Deliberate self-harm, suicide, intentional crime, resistance to criminal compulsory

measures taken according to the law on the part of the Insured;

3. Fighting, drunkenness or affected by alcohol, and active taking, sucking or injection of drugs on the part of the Insured;

4. Driving under the influence, driving without a legal and valid driving license or driving a motor vehicle without a valid driving license on the part of the Insured;

5. War, military conflict, riot or armed rebellion;

6. Nuclear explosion, nuclear radiation or nuclear pollution;

7. Pregnancy, abortion, miscarriage, delivery (including caesarean birth), birth control, treatment of infertility, contraceptive sterilization, artificial impregnation and related complication on the part of the Insured;

8. Medical accident occurring to the Insured because of cosmetic surgery or other surgical operations;

9. Taking of medicine (excluding OTC medicine taken according to instructions) without permission of doctor on the part of the Insured;

10. During the period when the Insured suffers from AIDS or is infected with the AIDS virus (HIV-positive);

11. The Insured engages in high-risk activities such as diving, parachuting, mountain

climbing, bungee jumping, paragliding, expedition, wrestling, martial art, stunt

performance, horse racing, car racing, etc.

12. The Insured passes away or becomes disable outside mainland China.

13. Providing false insurance information, or international experts and teachers taking out an insurance policy as a student

14. Those accidents that occur during the time when foreign students do their part-time work; If the Insured is caused dead in any of the foregoing circumstances, Ping An shall terminate the insurance liability of the Insured.

II. Liability Exemption for Medical Insurance Liability (Medical Treatment of Accidental Injury,

Outpatient, Emergency and Hospitalization)

Ping An shall be exempted from the insurance liabilities for medical expenses caused by any of the following circumstances on the part of the Insured:

1. Deliberate killing or injury conducted by the policy-holder or beneficiary to the

Insured;

2. Deliberate self-harm, intentional crime or resistance to criminal compulsory measures taken according to the law on the part of the Insured;

3. Fighting, drunkenness or affected by alcohol, and active taking, sucking or injection of drugs on the part of the Insured;

4. Driving under the influence, driving without a legal and valid driving license or driving a motor vehicle without a valid driving license on the part of the Insured;

5. War, military conflict, riot or armed rebellion;

6. Nuclear explosion, nuclear radiation or nuclear pollution;

7. The insured suffers from congenital diseases, hereditary diseases, existing disease

(disease or symptoms that already exist prior to the date of insurance and

non-continuous within the insurance period);

8. The insured suffers from AIDS or HIV infection, sexually transmitted diseases;

9. Pregnancy, miscarriage or delivery on the part of the Insured, infertility treatment,

artificial insemination, prenatal and postnatal check, birth control, abortion and

complications caused by above-mentioned causes;

10. Medical accident occurring to the Insured because of cosmetic surgery or other surgical operations;

11. The medical expenses incurred by the Insured for dental care, such as washing teeth,

dentures, dental implants, false filling, porcelain teeth, etc., as well as expenses incurred

in oral restoration, orthodontics, oral health care and beauty; the reasonable medical

expenses of the Insurer's dental fillings, tooth nerve treatment, tooth pulling, tooth

impaction treatment and periodontal diseases (such as, periodontitis, gingivitis,

periapical inflammation, except for teeth cleaning) due to dental caries, dental pulp

disease and cracked teeth are within the insurance liability of the Insurer;

12. Expenses of orthopedics, correct procedure, plastic surgery or rehabilitation therapy received by the Insurer;

13. Items such as physical examination and disease screening for the Insured; various

medical treatment items for prevention, health care, recuperation, rest and special care:

such as various vaccines vaccination, foot reflexology massage therapy, fitness massage

and other items;

14. Taking, application or injection of medicine without the permission of doctor on the part of the Insured;

15. Medical expenses incurred outside Mainland China or in private hospitals within

Mainland China, and expenses incurred in drug stores and companies of medical

apparatus and instruments;

16. Accidents that occur outside Mainland China and the follow-up treatments as a

consequent on the part of the Insured;

17. Charge of telephone, transportation, etc. on the part of the Insured;

18. Sports and athletic activities of high risk only professionals participate. (The Insured engages in high-risk activities such as diving, parachuting, paragliding, roller skating, skiing, skating, bungee jumping, rock climbing, wrestling, judo, taekwondo, martial art, karate, fencing, etc.

19. Providing false insurance information, or international experts and teachers taking out an insurance policy as a student.

20. Experimental treatment and costs incurred for medical experiment purpose.

21. The insurant should turn to medical treatment in strict accordance with the hospital admissions standards. If not, the insurer does not reimburse the cost of hospitalization.

22. Medical treatment fees incurred without consulting in advance by dialling 400 telephone

numbers or not approved.

23. Relevant expenses incurred by foreign students during the time when they do their

part-time work.

Insurance premium

Note: Matters not mentioned herein shall be executed according to “Ping An Additional Disability

Guarantee Group Accident Insurance (2013) (Clause D)”, “Ping An One-year Group Term Life Insurance”, “Ping An Additional Accidental Injury Group Medical Insurance”, “Ping An Inpatient, Outpatient and Emergency Comprehensive Group Medical Insurance” and “Ping An Inpatient Group Medical Insurance”. If any dispute arises concerning the contents mentioned above, the Chinese interpretation shall prevail.

Do be sure to firstly call 4008105119 to make a diagnosis inquiry before you go to see a doctor.

Dear customers:

If you want to learn about the services of the settlement of a claim of comprehensive

insurance for people coming to China of Ping An Endowment Insurance Co., Ltd., please read this guide carefully.

(1) Procedures for insurance claims:

Standard procedures of insurance claims after the occurrence of insurance accident:

Telephone for consultation and report: 4008105119

Please call directly 4008105119 for medical consultation due to disease or accident. The rescuing doctor will provide consultation, diagnose, and medical guidance and instructions on the insurance claim. After consulting the doctor and getting outpatient treatment, if the doctor confirms that further hospitalization is required, the insured can apply for advanced payment of medical expense for hospitalization to the rescue company. After communication and confirmation between the rescue company and hospital, it will be decided whether the advanced payment procedures shall be started. If the insured is directly hospitalized without being inquired, recorded by the doctor of the rescue company as well as not being treated by the outpatient (including those whose conditions do not

meet the requirements of hospitalization but require the outpatient doctor to agree with

hospitalization), the rescue company will not be responsible for advanced payment of medical expense for hospitalization. If advanced payment for medical expenses is made without the above procedures, the insured will not be able to get compensation.

(2) Document to be presented for settlement of claims:

1) Death or accidental disability

A.Copy of passport and visa page of the Insured

B.Disability certificate when the Insured is disabled (an evaluation report shall be issued by the

assigned evaluation body)

C.Death certificate of the Insured

D. Copies of certificates of the relationship between the Insured and all the beneficiaries, and copies of identification proofs of the beneficiaries

E.Certificate of accident in case of an accident (in case of traffic accident, the traffic unit should issue a liability confirmation of traffic accident; in case of falling from the height and drowning, the public security organs or relevant departments shall issue the materials determining whether it is accidental or suicidal; in case of alcohol-induced accident, a quantitative report on the alcohol concentration shall be issued.)

2) Medical treatment for accidental injuries

A.Copies of passport and visa page of the Insured

B.Process and certificate of accident (in case of a traffic accident, the traffic unit should issue a liability confirmation of traffic accident, which is needed.)

C.Original of receipt

D.Medical record, detailed expenditure sheet and copies of examination report and laboratory test report of each respective treatment (date of examination and date of invoice shall be corresponding with each other).

3) Medical treatment for outpatient and emergency

A.Copies of passport and visa page of the Insured

B.Original of receipt

C.Medical record, detailed expenditure sheet and copies of examination report and laboratory test report of each respective treatment (date of examination and date of invoice shall be corresponding with each other).

If the fees reach the deductible of RMB650 Yuan, then the original invoice, medical record, detailed expenditure sheet and copy of examination report and laboratory test report of treatment that costs below 650 Yuan are also required to be presented.

4) Hospitalization

A.Copies of passport and visa page of the Insured

B. Certificate of the accident in case of an accident (in case of the traffic accident, the traffic unit

should issue a liability confirmation of traffic accident)

C. Original of receipt and detailed expenditure sheet for hospitalization

D. Copy of hospital discharge summary or medical record of hospitalization

Special instructions to item 2) to item 4) above:

(1) The Insured’s bank account opened in mainland China and accurate information of this account, including account No. , name, opening bank information, which can be obtained from a copy of deposit book and bank customer table, I must be attached to the claim settling documents for each request for compensation; (For details, please call 4008105119 )

(2) Where the insured treated in two or more hospitals (including two hospitals) respectively for one insured incident, relevant documents such as diagnosis certificate and medical record from relevant hospitals of each treatment shall be presented.

(3) Hospitals for treatment shall be limited to the public hospitals within the territory of Mainland China, and requested items and expenses that can be reimbursed should in accordance with the scope of local regulations of social basic medical insurance.

5) Application for nursing fee

Original Invoices of nursing fee issued by the hospital or by a nursing service company

Materials for claims settlement sent to 北京市西城区金融街 23 号平安大厦 9 层(邮编 100033)

Addressee: 来华项目组

Please Dial: 4008105119

This program is an insurance product mix

Please log in www.lxbx.net for latest insurance introduction.

This material is for your information; the final right of interpretation of the above content belongs to

Ping An Annuity Insurance Company, Ltd.

Chinese explanation prevails in case of contradiction arising out of the aforementioned contents.

内容编辑

内容编辑