To participate in conditions:

International students in China, students from Hongkong, Macao and Taiwan, as well as overseas Chinese students (identities of overseas Chinese could be proved by relative authority) in healthy condition, able to participate in study normally from 8 years old to 69 years old, are eligible to this policy.

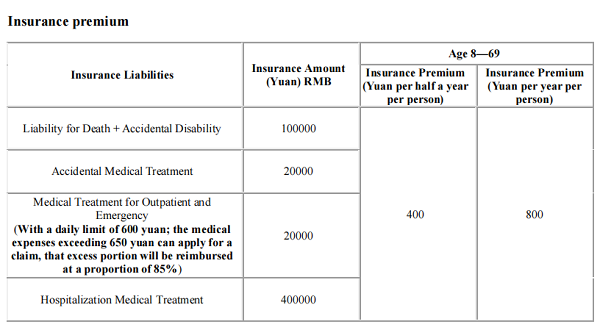

Insurance Liabilities:

Ping An shall undertake the following insurance liabilities during the valid period of insurance

(Insurance period (from the valid date of the policy to the expiry date of the insurance period))

1. Death insurance:

Ping An shall pay the stipulated amount of insurance compensation if the Insured dies of an accident or disease. Insurance liabilities thus terminate.

2. Accidental disability insurance:

If the Insured suffers from an accident which results in any disability listed in the Standards and Codes for Personal Insurance Disability Assessment (JR/T 0083-2013) (issued by China Banking and Insurance Regulatory Commission, BJF [2014] No. 6) within 180 days since the occurrence of the accident, Ping An shall assess the injury and disability according to the assessment principles stipulated by this Criteria, unless otherwise stipulated, Ping An shall pay the accidental disability insurance money, whose amount shall be calculated based on the multiplication of the proportion stipulated in this Criteria, which is corresponding to the assessment result, by the sum insured, which is corresponding to insurer’s responsibilities. If medical treatment is still not over on the 180th day, disability evaluation shall be made on the basis of the Insured’s physical condition on that day and the Insurance of Accidental Disability shall be paid in accordance with the evaluation results.

If with the disability resulted from this accident and the previous disability combined as a more serious disability according to the Standards and Codes for Personal Insurance Disability Assessment (JR/T 0083 —2013), the insurance shall be paid in accordance with the standard for the more serious disability, but the insurance of accidental disability which has been paid previously (disabilities listed in the Standards and Codes for Personal Insurance Disability Assessment (JR/T 0083-2013) have taken place before purchase of insurance or caused by events under Liability Exemption, shall be deemed as having been compensated already) shall be deducted therefrom.

The accumulative payment amount of accidental disability insurance, and death due to any accidental injury or disease shall not exceed the corresponding insured sum of the Insured. If the accumulative amount of payment exceeds the insured sum of the Insured, then the insurance

liabilities to the insured thus terminate.

3. Accidental Medical Insurance:

If the Insured, who suffers from the accidental incident, receives medical treatment within 180 days since the occurrence of the accident, the Insurer shall be liable for the full amount of the reasonable and necessary expenses actually paid by the Insured for the medical treatment, but the accumulative amount of payment shall not exceed RMB 20,000. Whether an accident happens to the Insured for once or several times, the Insurer shall pay the "accidental medical insurance" respectively in accordance with the aforesaid provisions, but the accumulative amount of payment shall not exceed the insured sum of the accidental medical insurance of the Insured. When the accumulative amount of payment reaches the insured sum of the accidental medical insurance of the Insured, the said insurance liability for the said Insured shall be terminated.

For example, the accidents such as bruises of bumps, burns, sprained ankle, accidental cut-wound when cutting vegetables, scratches or bites by cats and dogs.

Reimbursement equation: total amount of reasonable expenditure * 100%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the basic medical insurance).

4. Outpatient and Emergency Medical Insurance:

The reasonable and necessary expenses incurred by the Insured for receiving outpatient or emergency medical treatment because of illness, within each insurance period, the daily limit for outpatient is RMB600, (that means, if medical expense exceeding RMB 600 per day, shall be calculated as RMB600; if the medical expense not exceeding RMB600 per day, shall be calculated by the actual amount). Once the medical expenses exceeding the starting line of RMB650, the remaining amount of the medical expenses exceeding the deductible RMB650 yuan on the basis of the daily limit rules will be reimbursed at a percentage of 85%, and the accumulative payment shall not exceed the limit of RMB20000. The insurance liability shall be terminated once the accumulative amount of payment reaches the sum insured.

Medical expenses of outpatient and emergency treatment: The related expenses incurred from general outpatient treatment, emergency treatment, outpatient surgery, hospitalization for observation, emergency rescue, and expense or cost of outpatient and emergency treatment before and after hospitalization that arise from the same cause of disease are also deemed as outpatient and emergency treatment.

For example, being treated in the outpatient or emergency for fever, sudden abdominal pain, faint, and inflammation etc.

Reimbursement equation: (the expense of each day within the daily limit RMB600 yuan add up-650 yuan) * 85%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the basic medical insurance)

Definitions:

Daily limit: The top claim limit of available medical cost.

Deductible: RMB 650 yuan (A total of RMB650 yuan is deducted accumulatively for one time during an insurance period). Below the starting line, there is no compensation.

5. Hospitalization and Medical Insurance:

If diagnosis confirms that the Insured must be hospitalized for treatment because of suffering from the accident or the illness, Ping An shall pay 100% of the "hospitalization and medical insurance" to the insured with regard to the actual and reasonable expenses for medical treatment, including reasonable and necessary fees for nursing (limited to RMB200 Yuan per day and accumulate up to 60 days), medical record, heating, air-conditioning, bed, examination, special examination and treatment, operation, medicine, treatment, laboratory test, radiation, etc.

During one valid insurance period, whether the Insured is hospitalized for once or several times, the Insurer shall pay the insurance payment as per compensation rule, but the insurance liability shall be terminated once the accumulative amount of payment reaches the limitation of RMB 400,000.

In another word: if diagnosis confirms that the insured must be hospitalized for treatment because of suffering from the injury or illness, the insured may apply online for advanced payment by the hospital or athis own expense of medical expense for hospitalization and reimburse later.

Reimbursement equation: reasonable hospitalization expenditure*100%=reimbursable amount (the total amount of reasonable expenditures shall exclude the self-paid or partly self-paid items and expenses stipulated by the local regulations of the basic medical insurance).

Note:

1) Medical organizations which are involved in all the foregoing medical insurance liabilities are limited to the public hospitals established within the border of Mainland China; However, for the insured who are treated in the ward area for foreigners, ward area for VIPs, private room, Class A ward, separate ward room, ward area for special treatment and needs, ward for special treatment and needs, ward for high-ranking officials, rehabilitation center, convalescent home or similar ward area of the public hospitals, shall be excluded from the insurance, then all medical expenses incurred by such shall not be covered by the insurer.

2) Medical treatment expenses generated by all the foregoing medical insurance liabilities are limited to the items and expenses that can be reimbursed in accordance with the local regulations of basic medical insurance, the self-paid or partly self-paid items and expenses cannot be reimbursed by the insurer.

3) For the insured who apply for the insurance for the first time or the insured who is not renewal of insurance, the first 30 days from the effective date of the insurance is the waiting period (observation period). Where the insured is hospitalized or treated in outpatient during the waiting period and related medical cost occurs, the insurer bears no liability of compensation. Insurance renewal or the treatment for the Insured suffered from an accident is not subject to any waiting period.

4) If any third party has partially or fully paid any above-mentioned medical treatment fees, Ping An shall be liable for the remaining amount of reasonable fees that are within the reimbursable payment scope of the local basic medical insurance. But the limited portion of the fees for the bed, nursing, outpatient and emergency treatment within the daily limitation is also limited; if the third party has a specified proportion for payment of the limited sum, Ping An shall be liable only for the remaining amount after deducting the already paid amount from the limited sum. If the third party has no specified proportion for payment, then Ping An shall be liable for the remaining amount, but not exceeding the insured sum, after deducting the standard amount of this item from the limited sum which takes the regulations of the local basic medical insurance as the standard.

5) If the Insured suffers from a major disease or a chronic disease before the purchase of this insurance, the Insurer shall not bear the liability of payment.

Liability Exemption

I. Liability Exemption for Death and Accidental Disability InsurancePing An shall be exempted from the insurance liabilities for death and accidental disability caused by any of the following circumstances on the part of the Insured:

1. Deliberate killing or injury conducted by the policy-holder or beneficiary to the Insured;

2. Deliberate self-harm, suicide, intentional crime, resistance to criminal compulsory measures taken according to the law on the part of the Insured;

3. Fighting, drunkenness or affected by alcohol, and active taking, sucking or injection of drugs on the part of the Insured;

4. Driving a motor vehicle under the influence, driving a motor vehicle without a legal and valid driver’s license or driving a motor vehicle without a legal and valid driving license on the part of the Insured;

5. War, military conflict, riot or armed rebellion;

6. Nuclear explosion, nuclear radiation or nuclear pollution;

7. Pregnancy, abortion, miscarriage, delivery (including caesarean birth), birth control, treatment of infertility, contraceptive sterilization, artificial impregnation and related complication on the part of the Insured;

8. Medical accident occurring to the Insured because of cosmetic surgery or other surgical operations;

9. Taking of medicine (excluding OTC medicine taken according to instructions) without permission of doctor on the part of the Insured;

10. During the period when the Insured suffers from AIDS or is infected with the AIDS virus (HIV-positive);

11. The Insured engages in high-risk activities such as diving, parachuting, mountain climbing, bungee jumping, paragliding, expedition, wrestling, martial art, stunt performance, horse racing, car racing, etc.;

12.The Insured passes away or becomes disability because of an accident outside mainland China;

13. Providing false insurance information, or non-overseas students insured as an overseas student;

14. Those accidents that occur during the time when the Insured do their part-time job.

If the Insured is caused dead in any of the foregoing circumstances, Ping An shall terminate the insurance liability of the Insured.

II. Liability Exemption for Medical Insurance Liability (Accidental Medical Treatment, Outpatient, Emergency and Hospitalization)

Ping An shall be exempted from the insurance liabilities for medical expenses caused by any of the following circumstances on the part of the Insured:

1. Deliberate killing or injury conducted by the policy-holder or beneficiary to the Insured;

2. Deliberate self-harm, intentional crime or resistance to criminal compulsory measures taken according to the law on the part of the Insured;

3. Fighting, drunkenness or affected by alcohol, and active taking, sucking or injection of drugs on the part of the Insured;

4. Driving a motor vehicle under the influence, driving a motor vehicle without a legal and valid driver’s license or driving a motor vehicle without a legal and valid driving license on the part of the Insured;

5. War, military conflict, riot or armed rebellion;

6. Nuclear explosion, nuclear radiation or nuclear pollution;

7. The insured suffers from congenital diseases, hereditary diseases, existing disease (disease or symptoms that already exist prior to the date of insurance and non-continuous within the insurance period);

8. The insured suffers from AIDS or HIV infection, sexually transmitted diseases;

9. Pregnancy, miscarriage or delivery on the part of the Insured, infertility treatment, artificial insemination, prenatal and postnatal check, birth control (including sterilization), abortion and complications caused by above-mentioned causes;

10. Medical accident occurring to the Insured because of cosmetic surgery or other surgical operations;

11. The medical expenses incurred by the Insured for dental care, such as washing teeth, dentures, dental implants, false filling, porcelain teeth, etc., as well as expenses incurred in oral restoration, orthodontics, oral health care and beauty; the reasonable medical expenses of the Insurer's dental fillings, tooth nerve treatment, tooth pulling, tooth impaction treatment and periodontal diseases (such as, periodontitis, gingivitis, periapical inflammation, except for teeth cleaning) due to dental caries, dental pulp disease and cracked teeth are within the insurance liability of the Insurer;

12. Expenses of orthopedics, correct procedure, plastic surgery or rehabilitation therapy received by the Insurer;

13. Items such as physical examination and disease screening for the Insured; various medical treatment items for prevention, health care, recuperation, rest and special care: such as various vaccines vaccination, foot reflexology massage therapy, fitness massage and other items;

14. Taking, application or injection of medicine without the permission of doctor on the part of the Insured;

15. Medical expenses incurred outside Mainland China or in private hospitals within Mainland China, and expenses incurred in drug stores and companies of medical apparatus and instruments;

16. Accidents that occur outside Mainland China and the follow-up treatments as a consequent on the part of the Insured;

17. Charge of telephone, transportation, meals, etc. on the part of the Insured;

18. Sports and athletic activities of high risk only professionals participate. (The Insured engages in high-risk activities such as diving, parachuting, paragliding, roller skating, skiing, skating, bungee jumping, rock climbing, wrestling, judo, taekwondo, martial art, karate, fencing, etc.;

19. Providing false insurance information, or non-overseas students insured as an overseas student;

20. Experimental treatment and costs incurred for medical experiment purpose;

21. The insurant should turn to medical treatment in strict accordance with the hospital admissions standards. If not, the insurer does not reimburse the cost of hospitalization;

22. Medical treatment fees incurred without reporting in advance by dialing 400 telephone numbers or not approved;

23. Relevant expenses incurred by the Insured during the time when they do their part-time

work.

Note: The above insurance product package is applicable to Ping An One-year Group Term Life Insurance (Registration No.: Ping An Annuity Release [2021] No. 602, Filing Code: Ping An Annuity [2021] Term Life Insurance No. 105), Ping An Additional Accidental Injury Group Medical Insurance (Registration No.: Ping An Annuity Release [2020] No. 413, Filing Code: Ping An Annuity [2020] Medical Insurance No. 081), Ping An Inpatient Group Medical Insurance (Registration No.: Ping An Annuity Release [2020] No. 413, Filing Code: Ping An Annuity [2020] Medical Insurance No. 090), Ping An Inpatient, Outpatient and Emergency Comprehensive Group Medical Insurance (Registration No.: Ping An Annuity Release [2020] No. 413, Filing Code: Ping An Annuity [2020] Medical Insurance No. 091), and Ping An Inpatient Reassuring Group Medical Insurance (Clause A) (Registration No.: Ping An Annuity Release [2021] No. 605, Filing Code: Ping An Annuity [2021] Medical Insurance No. 118). If the contents of the insurance product package conflict with the terms, the contents of this insurance product package will take precedence. Any matters not covered herein shall be executed according to the terms of the insurance policies.

If any dispute arises concerning the contents mentioned above, the Chinese interpretation shall prevail.Please be sure to call 4008105119 firstly to make a diagnosis inquiry before you go to see a doctor.

Dear customers:

If you want to learn about the services of the settlement of a claim of comprehensive insurance for people coming to China of Ping An Endowment Insurance Co., Ltd., please read this guide carefully.

(1) Procedures for insurance claims:

Standard procedures of insurance claims after the occurrence of insurance accident:

Telephone for consultation and report: 4008105119

Please call directly 4008105119 for medical consultation due to disease or accident. The rescuing doctor will provide consultation, diagnose, and medical guidance and instructions on the insurance claim. After consulting the doctor and getting outpatient treatment, if the doctor confirms that further hospitalization is required, the insured can apply for advanced payment of medical expense for hospitalization to the rescue company. After communication and confirmation between the rescue company and hospital, it will be decided whether the advanced payment procedures shall be started. If the insured is directly hospitalized without being inquired, recorded by the doctor of the rescue company as well as not being treated by the outpatient (including those whose conditions do not meet the requirements of hospitalization but require the outpatient doctor to agree with hospitalization), the rescue company will not be responsible for advanced payment of medical expense for hospitalization. If advanced payment for medical expenses is made without the above procedures, the insured will not be able to get compensation.

(2) Document to be presented for settlement of claims:

1) Death or accidental disability

A .Copy of passport and visa page of the Insured

B .Disability certificate when the Insured is disabled (an evaluation report shall be issued by the assigned evaluation body)

C .Death certificate of the Insured

D.Copies of certificates of the relationship between the Insured and all the beneficiaries, and copies of identification proofs of the beneficiaries

E.Certificate of accident in case of an accident (in case of traffic accident, the traffic unit should issue a liability confirmation of traffic accident; in case of falling from the height and drowning, the public security organs or relevant departments shall issue the materials determining whether it is accidental or suicidal; in case of alcohol-induced accident, a quantitative report on the alcohol concentration shall be issued.)

2) Accidental medical treatment

A .Copies of passport and visa page of the Insured

B .Process and certificate of accident (in case of a traffic accident, the traffic unit should issue a liability confirmation of traffic accident, which is needed.)

C .Original of receipt

D .Medical record, detailed expenditure sheet and copies of examination report and laboratory test report of each respective treatment (The date of the medical record and the date of invoice shall be corresponding with each other).

3) Medical treatment for outpatient and emergency

A .Copies of passport and visa page of the Insured

B .Original of receipt

C .Medical record, detailed expenditure sheet and copies of examination report and laboratory test report of each respective treatment (The date of the medical record and the date of invoice shall be corresponding with each other).

If the fees reach the deductible of RMB650 Yuan, then the original invoice, medical record, detailed expenditure sheet and copy of examination report and laboratory test report of treatment that costs below RMB650 Yuan are also required to be presented.

4) Hospitalization

A .Copies of passport and visa page of the Insured

B .Certificate of the accident in case of an accident (in case of the traffic accident, the traffic unit should issue a liability confirmation of traffic accident)

C .Original of receipt and detailed expenditure sheet for hospitalization

D .Copy of hospital discharge summary or medical record of hospitalization

Special instructions to item 2) to item 4) above:

(1) The Insured’s bank account opened in mainland China and accurate information of this account, including account number, name, opening bank information, which can be obtained from a copy of deposit book and bank customer table, it must be attached to the claim settling documents for each request for compensation (For more details, please call 4008105119).

(2) Where the insured treated in two or more hospitals (including two hospitals) respectively for one insured incident, relevant documents such as diagnosis certificate and medical record from relevant hospitals of each treatment shall be presented.

(3) Hospitals for treatment shall be limited to the public hospitals within the territory of Mainland China, requested items and expenses that can be reimbursed should in accordance with the scope of local regulations of basic medical insurance.

5) Application for nursing fee

Original Invoices of nursing fee issued by the hospital or by a nursing service company

Materials for claims settlement sent to 北京市西城区金融街 23 号平安大厦 9 层(邮编 100033) Addressee: 来华项目组

Please Dial: 4008105119

内容编辑

内容编辑